2025 Standard Deduction Over 65 And Blind

2025 Standard Deduction Over 65 And Blind. The additional standard deduction for people who are 65 or older is $1,950 for single filers or heads of household, and $1,550 for married couples filing jointly. The 2025 standard deduction amounts are as follows:

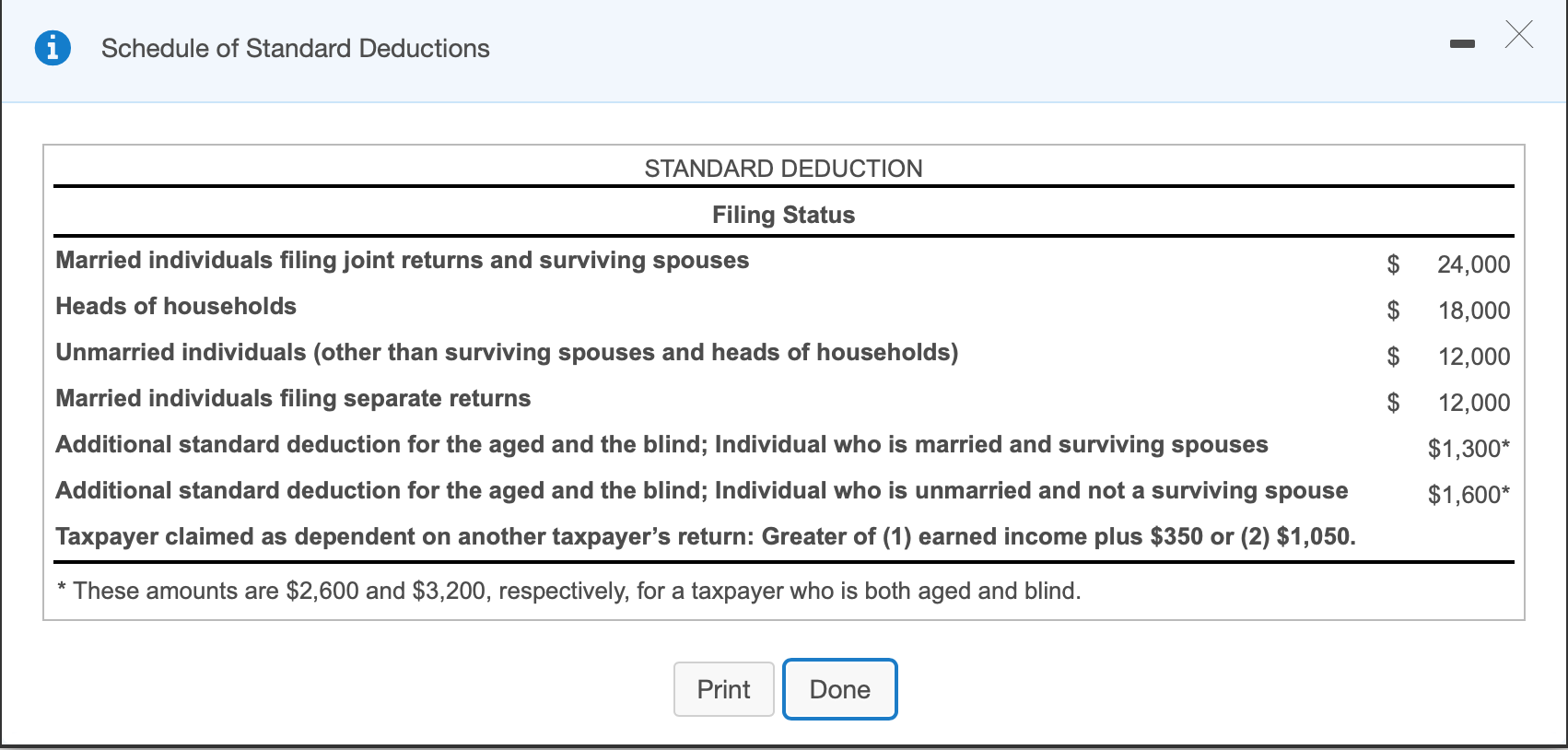

In tax year 2025, the standard deductions are as follows: If you’re at least 65 years old or considered legally blind at the end of 2025, you’re entitled to an additional standard deduction for the 2025 tax year in the following.

2025 Standard Deduction Over 65 And Blind Darda Elspeth, For taxpayers who are blind or at least age 65, you can claim an additional standard deduction.

2025 Irs Standard Deduction Over 65 Age Dedra Bethena, It’s $3,000 per qualifying individual if you are.

Tax Standard Deduction 2025 Over 65 Evvie Raynell, If you are 65 or older and blind, the extra standard deduction is $3,700 if you are single or filing as head of household.

Standard Deduction For 2025 Over 65 Single Rea Leland, Standard deductions for taxpayers over 65.

2025 Standard Deduction Over 65 And Blind Layla Mozelle, Taxpayers get a higher standard deduction when they turn 65 or are blind.

Standard Deduction For 2025 Single Over 65 Melli Siouxie, The 2025 standard deduction amounts are as follows:

2025 Standard Deduction Over 65 And Blind Bunny Meagan, $3,000 per qualifying individual if you are.

Standard Deduction 2025 Single Over 65 Juli Saidee, Taxpayers get a higher standard deduction when they turn 65 or are blind.

2025 Standard Deduction Over 65 Calculator Jade Roselle, $3,000 per qualifying individual if you are.

Standard Deduction 2025 Over 65 Married Blind Perle Terrijo, Certain taxpayers, such as those who are blind or age 65 or older, usually get a higher standard deduction, sometimes called an additional standard deduction.