Defined Contribution Plan Limits 2025

Defined Contribution Plan Limits 2025. The 415 (c) contribution limit applicable to defined contribution retirement plans increased from. Defined contribution plan limits 2025 2025 change;

In the context of measuring a pension. On november 1, the internal revenue service (irs) announced new contribution limits for.

Significant HSA Contribution Limit Increase for 2025, Defined contribution plans in total. The 415 (c) contribution limit applicable to defined contribution retirement plans increased from.

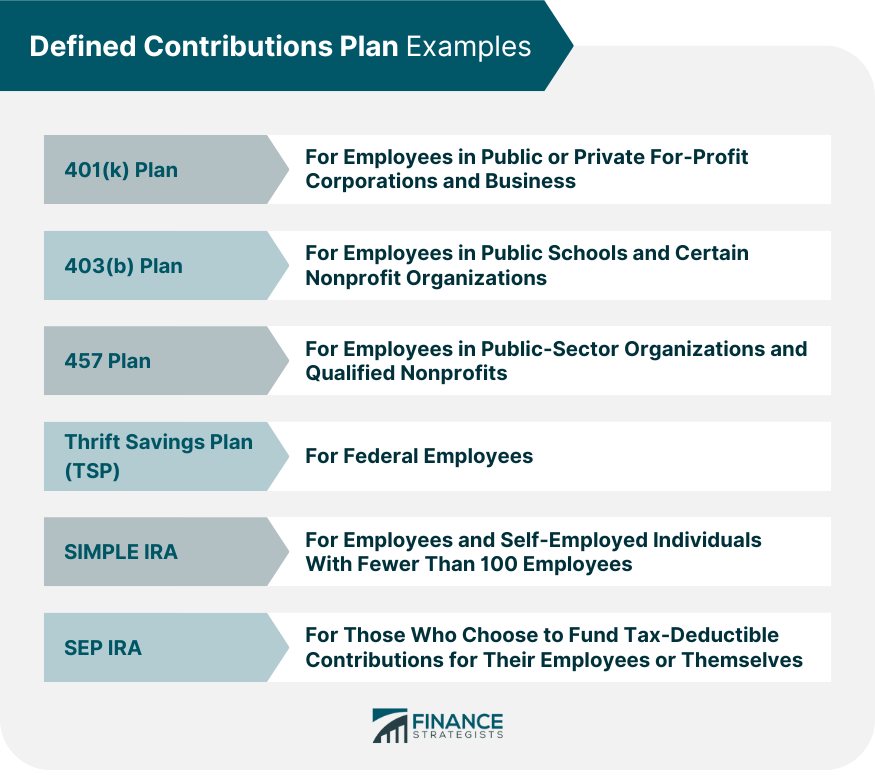

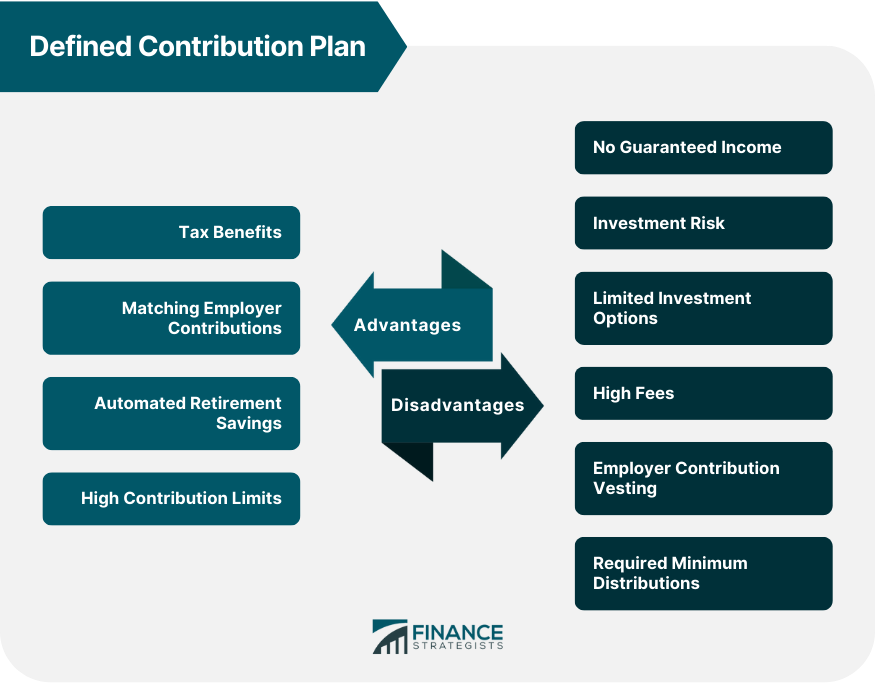

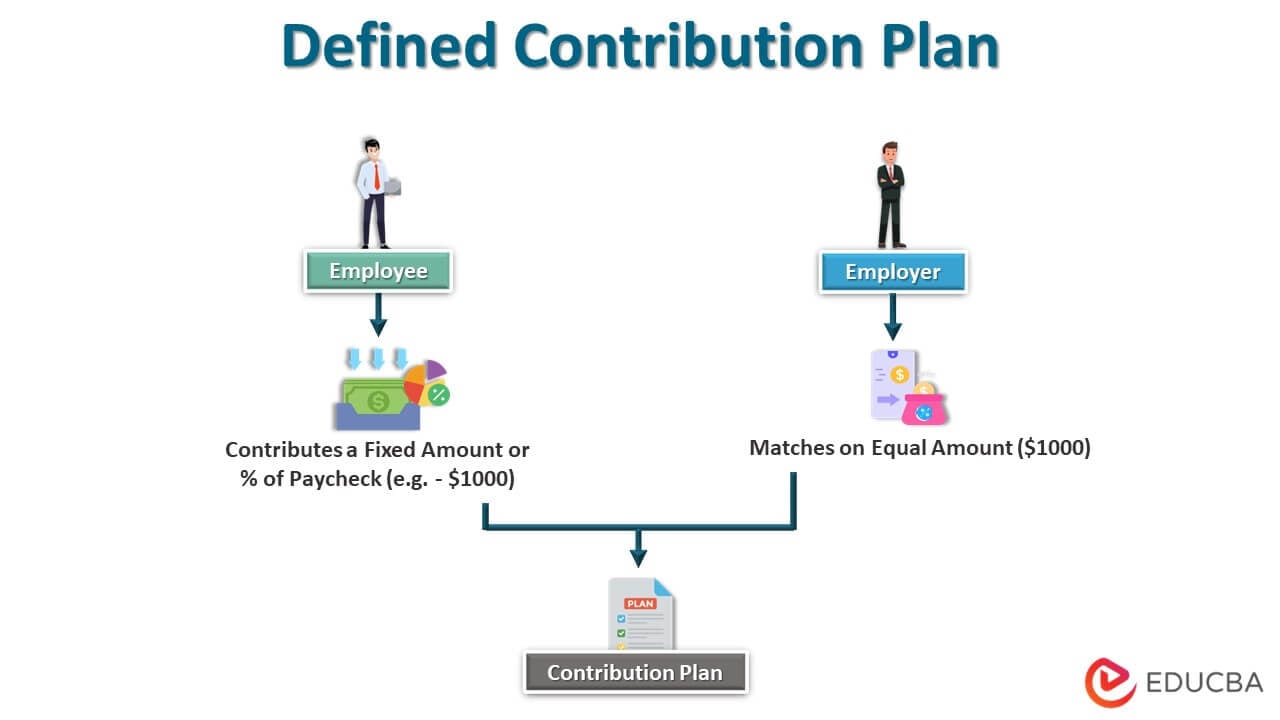

Defined Contribution Plan Meaning, How It Works, Pros & Cons, The irs released new limits for retirement contributions for 2025. The limit on annual contributions to these plans, commonly referred to as “pensions,” will increase to $69,000 (up from $66,000).

Defined Contribution Plan Meaning, How It Works, Pros & Cons, Annual contributions to defined contribution plans: Maximum employee elective deferral (age 49 or younger) 1.

2025 Plan Contribution Limits Announced by IRS Abbeystreet, The 415 (c) contribution limit applicable to defined contribution retirement plans increased from. • the term “annual additions” generally.

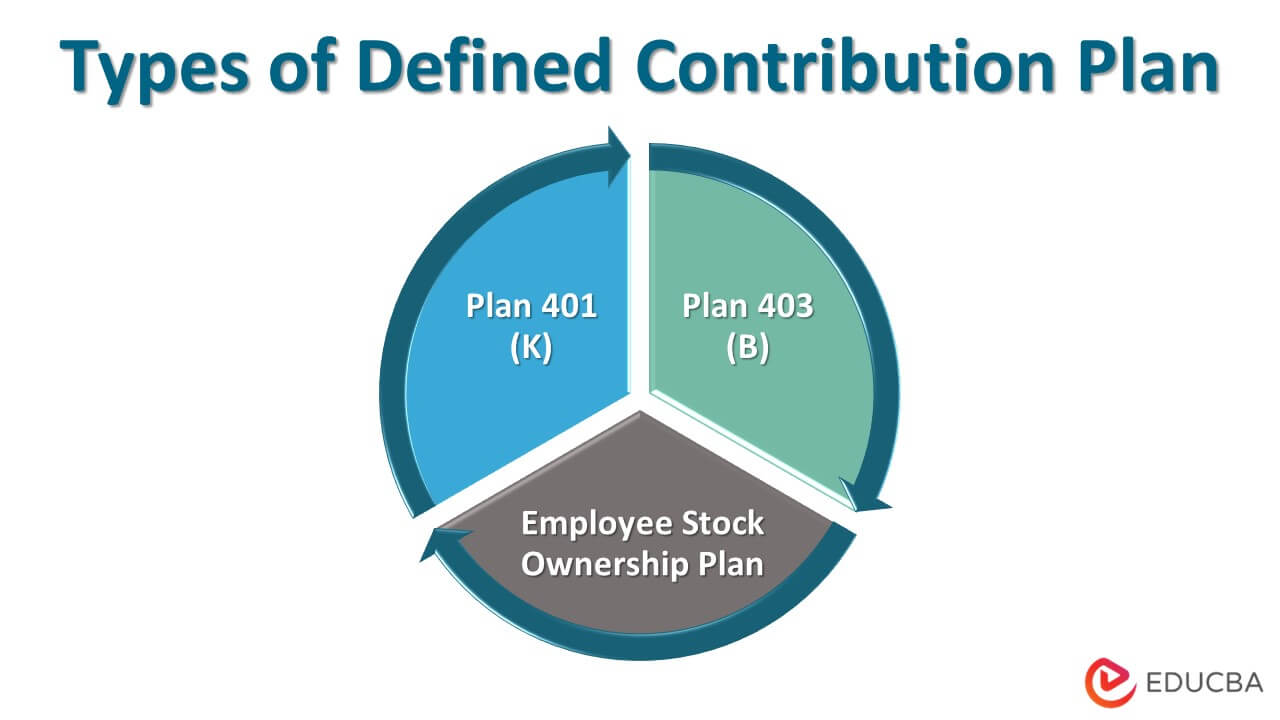

Defined Contribution Plan How Does It Work with Types & Example?, Maximum employee elective deferral (age 49 or younger) 1. The irs released new limits for retirement contributions for 2025.

Defined Contribution Plan Contribution Limit and Pros & Cons, The limit on annual contributions to these plans, commonly referred to as “pensions,” will increase to $69,000 (up from $66,000). To fund the account, you’ll link an.

Defined Contribution Plan Contribution Limit and Pros & Cons, In 2025, the contribution limit for a roth. Irs announces 2025 retirement plan contribution and benefit limits.

Defined Contribution Plan How Does It Work with Types & Example?, An overall limit on contributions to a participant’s account. The funding ratio calculation is a simple one.

Defined Contribution Plan Meaning, How It Works, Pros & Cons, The 415 (c) contribution limit applicable to defined contribution retirement plans increased from. An actuarial calculation can determine how much you can.

Defined Benefit Plans Detail • Defined Benefit Plan Solutions, Due to both the autumn statement 2025 and spring budget 2025 cuts to national insurance, and changes to the high income child benefit charge, the obr. The highlights of limitations that changed from 2025 to 2025 include the following:

The defined benefit plan limit varies on a number of factors, including the business owner's age and earned income.