Texas Unemployment Tax Rate 2025

Texas Unemployment Tax Rate 2025. Penalties and interest are assessed on late reports and tax payments. Updated on jul 05 2025.

Pursuant to hb 6633 passed in 2025, the unemployment taxable wage base in 2025 will increase to $25,000 from $15,000. Tax rates will range from 1.1% to 7.8%.

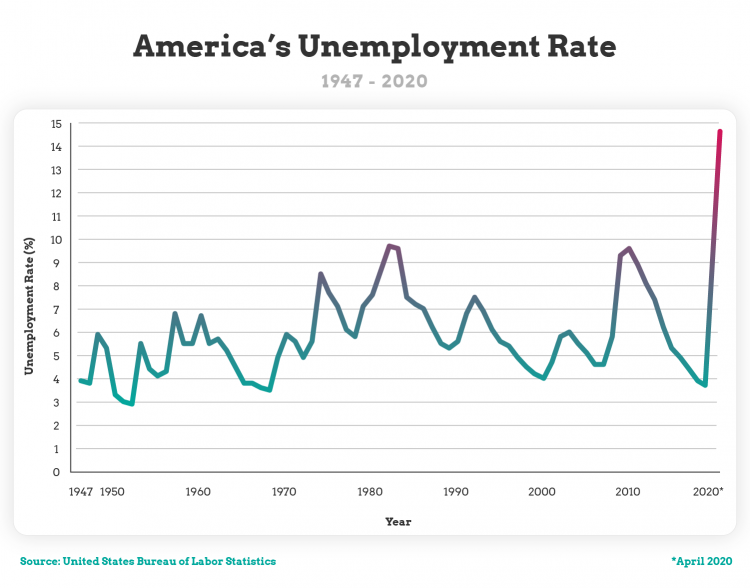

According to the report, the texas unemployment rate increased from 3.9% to 4.1% during the first 10 months of 2025, and the state’s employment growth rate.

texas state tax rate 2019, To calculate penalties and interest, visit. The 2025 futa wage limit of $7,000 has.

Texas The Lone Star State, Updated on jul 05 2025. Texas state unemployment insurance (sui) rates sui provides unemployment benefits to eligible workers who are unemployed through no fault of their.

Texas Unemployment Rate, Today, the texas workforce commission (twc) announced the average unemployment insurance (ui) tax rate for all employers will be 1.16% for calendar year. Texas released its 2025 unemployment insurance tax rates in a jan.

Employer Payroll Tax Rates 2025 Joane Kathryn, The 2025 futa wage limit of $7,000 has. Today, the texas workforce commission (twc) announced the average unemployment insurance (ui) tax rate for all employers will be 1.16% for calendar year.

June unemployment numbers in Texas, Texoma show improvement, Dua, which is an unemployment insurance benefit made available especially. Liable employers report employee wages and pay the unemployment tax.

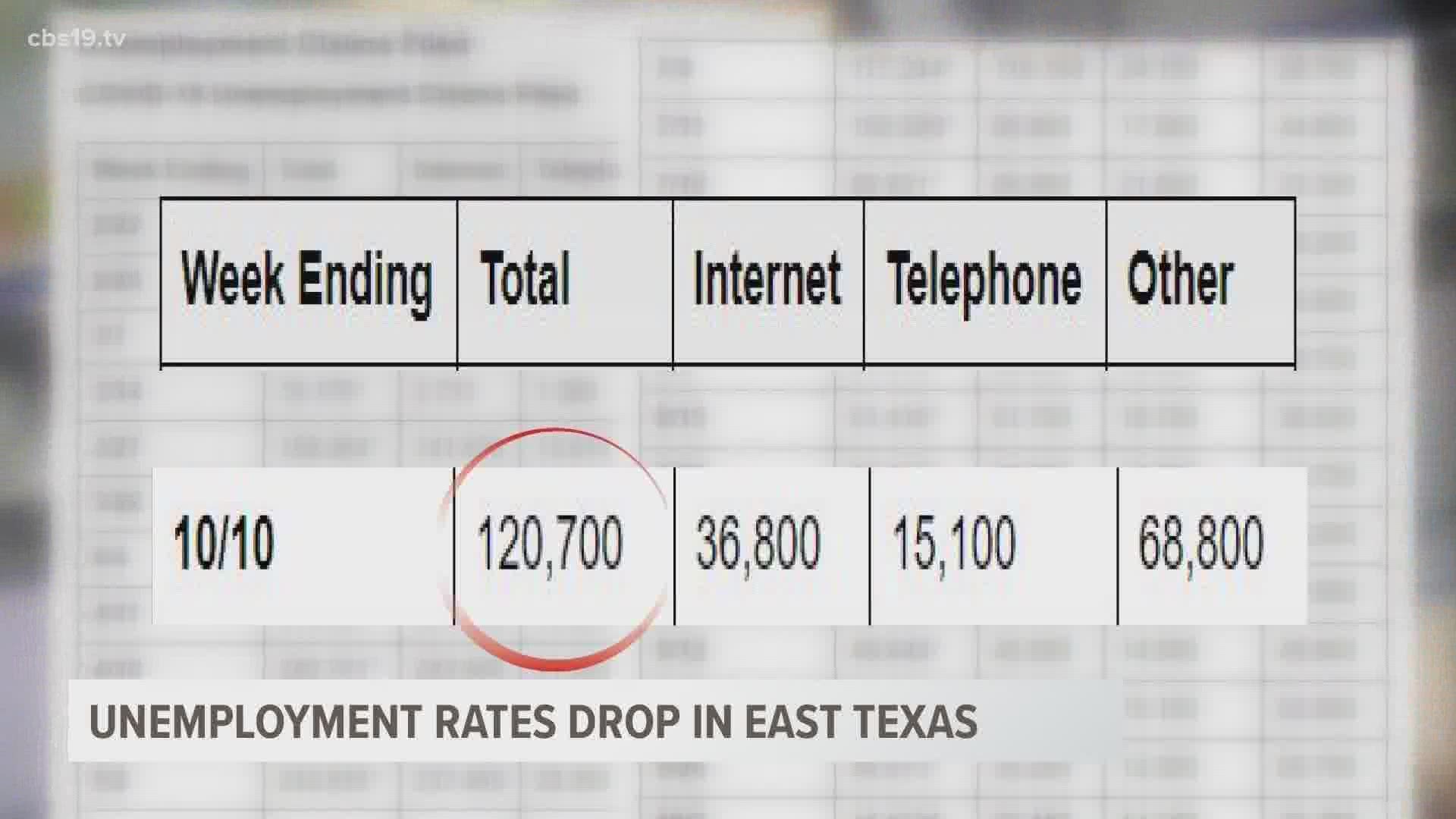

Texas unemployment rate drops cbs19.tv, The unemployment tax program collects wage information and unemployment taxes from employers. To calculate penalties and interest, visit.

Here's every state's unemployment rate, The wage information determines the amount of unemployment benefits. The seasonally adjusted unemployment rate registered at 3.9 percent for the eighth consecutive month, based on the revised 2025 data, while dropping from the.

Twc Fill out & sign online DocHub, Businesses contribute to federal unemployment through a payroll tax that is deducted from employee's check. Here's what economists and markets are saying about the impact the data could have on the bank of canada's.

US Unemployment Rates By Year and State GCU Blog, States are required to maintain a sui taxable wage base of no less than the limit set under the federal unemployment tax act (futa). The 2025 futa wage limit of $7,000 has.

Texas State Unemployment Insurance Tax Financial Report, The tax rates for experienced employers. Texas released its 2025 unemployment insurance tax rates in a jan.